4.9/5 based on 100+ happy customers

Feel Confident in Your Aged Care Decisions

With over 20 years of experience in aged care, our team of advisers will offer you the best aged care financial advice for your unique needs.

Specialist Aged Care Advisers

20+ Year Experience

Licensed and Qualified

Call us on 1300 944 011

BENEFITS

How Our Aged Care Advice Can Help You

Reduce Aged Care Fees

We will work diligently to identify potential opportunities to minimise your aged care fees.

Maximise Government Support

We will explore various avenues to help you leverage government support and benefits available for aged care.

Avoid Family Disputes

As an enduring power of attorney, protect yourself from serious legal errors. Even small mistakes can have significant consequences.

Protect The Family Home

Explore strategies to keep your family home while effectively covering aged care costs.

Determine How To Pay Aged Care Fees

One of our primary goals is to develop strategies that guarantee a steady cash flow to cover your aged care home fees.

Avoid Expensive Mistakes

Aged care finances are complex. One small mistake can cost thousands annually.

HOW IT WORKS

Our Aged Care Financial Advice Process

Book a Free Consultation

During this initial, obligation-free meeting, our priority is to gain a comprehensive understanding of your situation. We will provide general guidance about aged care and assess the level of advice and support you may require.

Receive Personalised Financial Advice

We develop a customised plan to optimise the structure of your assets, investments, and income to best fund aged care. Our goal is to minimise aged care fees, maximise centrelink benefits and protect the family home.

Review Aged Care Contracts

We thoroughly review all contracts to ensure there are no errors from the aged care home or Centrelink. By handling all communications with the aged care home, we allow you to concentrate on caring for your loved one.

Transition Your Loved One with Confidence

You can move your loved one into aged care with confidence, knowing they are receiving the best possible care and their finances are protected. Importantly, you have fulfilled your duties as an EPA.

Save an Average of $7,000 Annually

Making informed financial decisions before transitioning into aged care can typically result in residents being $5,000 to $10,000 better off each year during their stay.

Understand Your Aged Care Options

Making decisions about aged care begins with a clear understanding of how your current financial situation will impact your future and your family’s.

Our experienced advisers will thoroughly assess your finances and clearly outline all available aged care options. With our expertise, we can structure your finances in a way that maximises the value of your hard-earned assets.

A Stress-Free Transition Into Aged Care

The transition into aged care can be an emotional time for all involved. Attempting to navigate your way through the costs and rules of assisting someone into care at the same time can be overwhelming.

Our goal is to take the burden of transitioning into aged care off your shoulders. We remove all the stress and concerns you may have when you placing a loved one in a care facility.

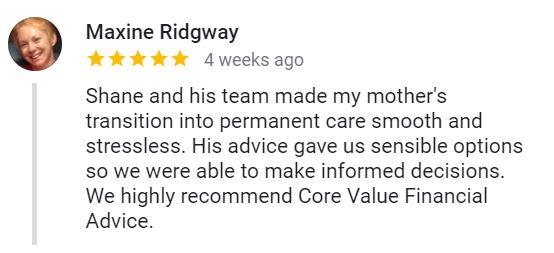

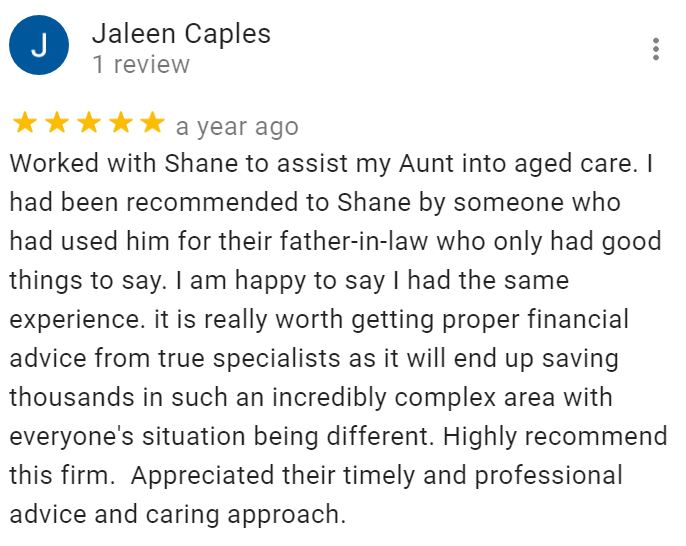

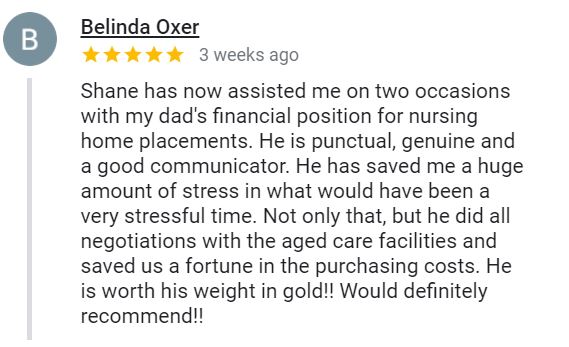

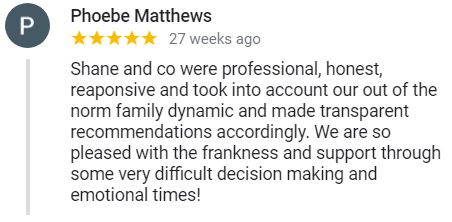

TESTIMONIALS

See what others are saying…

Organisations We’ve Liaised With

Talk to an Aged Care Expert Today!

Fill out the form below for a response within 2 business hours,

or call 1300 944 011 for immediate assistance

Frequently Asked Questions

What Is Aged Care Financial Advice?

Aged care financial advice is specialised financial guidance tailored to help individuals and their families navigate the financial complexities of aged care. This advice can cover various aspects, including options for your family home, aged care fees, accommodation payments, and cash flow and investment strategies, all aimed at optimally funding aged care and keeping aged care costs to a minimum.

Why Do I Need Financial Advice for Aged Care?

Navigating the aged care system in Australia can be complex and costly. Financial advice can help you understand the fees involved, optimise your income and assets, and make informed decisions, so that you can focus on what’s most important; spending time with your loved one.

What Are the Costs Associated With Aged Care?

Costs can include a basic daily fee, a means-tested care fee, accommodation payments (which can be a lump sum or daily payments), and fees for extra or optional services. Our advisers can explain these in detail and help you understand what applies to your situation.

Do I Need To Sell the Home To Pay for Aged Care?

There are several strategies to fund aged care without selling your home. Our aged care advisers can discuss these options based on your specific circumstances.

Can I Rent The Family Home To Pay for Care?

You can rent the family home to pay for care. However, the decisions you make as to whether the home is retained or sold will not only affect aged care fees, but will also impact Centrelink Age Pension payments. This is something that should be discussed with an adviser before making a decision.

Who Pays for Aged Care if You Run Out of Money?

Most nursing homes these days will require a family member or Power of Attorney to sign-off as a guarantor on the initial contract, meaning they will be liable to cover aged care costs in the event that you run out of money or are unable to cover the fees yourself.

What Government Support Is Available for Aged Care?

The Australian Government provides subsidies for aged care homes. These subsidies are determined by an assessment of your care needs and your financial situation. Our advisers can help you understand what you’re entitled to and optimise your situation to be eligible for more support.

Do You Offer a Free Initial Consultation?

Yes we do! Click the button below or call 1300 944 011 to arrange a free consultation with one of our aged care financial advisers. We will take the time to understand your unique needs and goals, determining the level of advice you require, if any.

What Information Do I Need To Prepare for a Free Initial Consultation

We won’t require any detailed information, just general details. Specifically, we’ll need to know if there is a family home, its value, the amount in bank accounts, and any other investments. Only approximate amounts are necessary; statements are not needed.

GET IN TOUCH